south dakota sales tax filing

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. If you are stuck or have questions you can contact the state of South Dakota directly by telephone at 605 773.

Sales Use Tax South Dakota Department Of Revenue

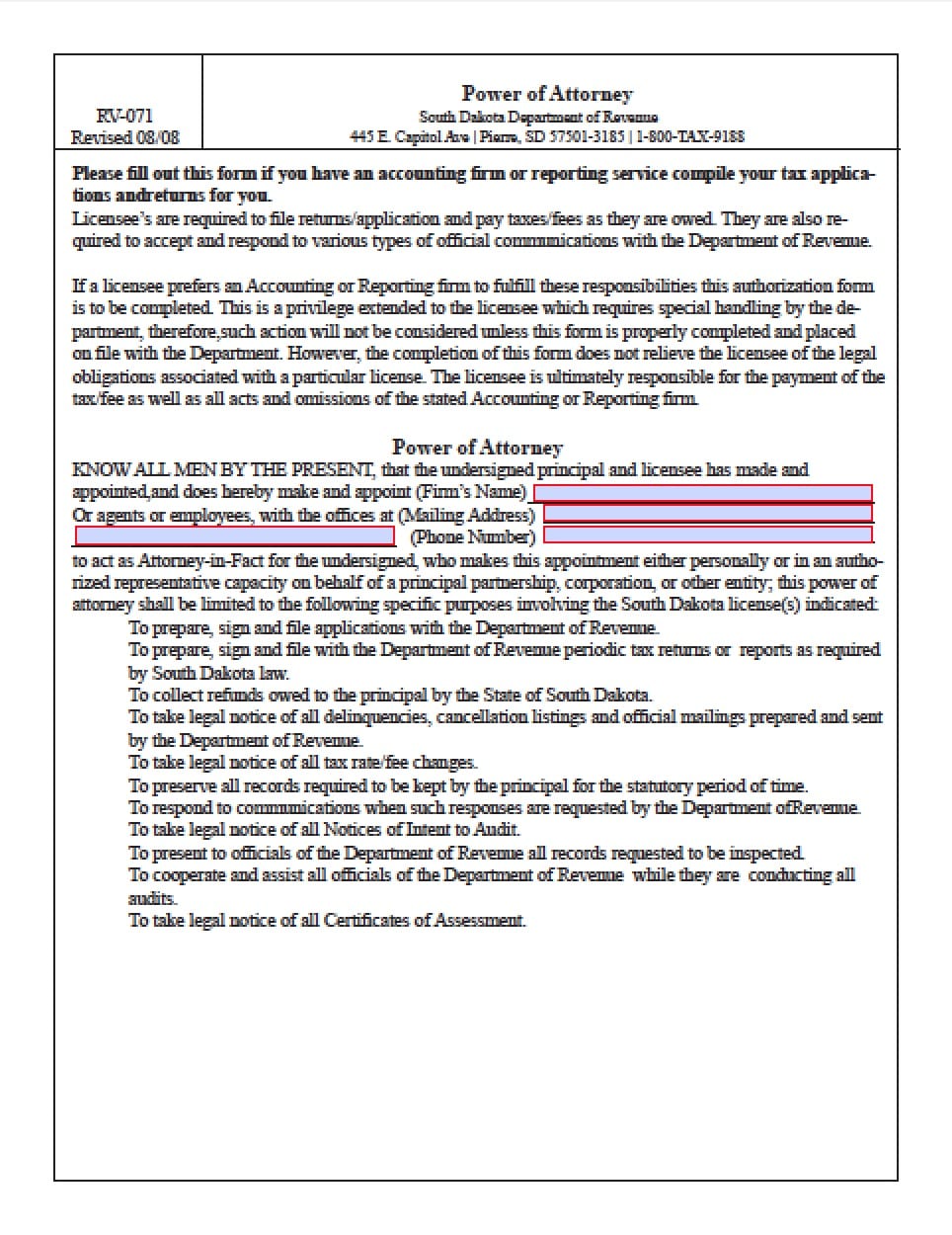

Tax calculation filing of tax returns and tax payments.

. Sales Tax Holiday Repealed. Not a huge savings but no reason to not capitalize on this potential saving so be sure to file early. C 196 L 21.

The South Dakota Department of Revenue administers these taxes. South Dakota Sales Tax Filing Address. If a business sells taxable tangible.

In order to file sales. State Sales and Use Tax Rate. Late filing of your South Dakota sales tax returns or late payment of the tax due will result in penalties imposed by the state.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. The process of filing sales tax in South Dakota consists of three primary steps.

In South Dakota you will be required to file and remit sales tax either at the states discretion and this can be monthly bimonthly quarterly or semi-annually. The penalty for a failure to pay within 30 days of the due date. South Dakota offers 15 to a maximum of 70.

The state also has several special taxes and local jurisdiction taxes at the city and county levels. State Registration for Sales and Use Tax. They may also impose a 1 municipal gross.

Small Retailer Property Tax Relief Credit. CorporateUnincorporated Tax Forms 2022 Tax Filing Season Tax Year 2021. Depending on the volume of sales taxes you collect and the status of your sales tax account with South Dakota you may be required to file sales tax returns on a monthly semi-monthly.

In addition to the sales tax cities can levy a 2 municipal sales and use tax and a 1 municipal gross receipts tax on certain goods and services. Please note that if you file your South Dakota sales taxes. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

Learn what you need to file pay and find information on taxes for the general public. Sioux Falls SD 57117-5055. Municipalities may impose a general municipal sales tax rate of up to 2.

State Contacts 800 829-9188 Email SD. Now that we have covered all. How to Get Help Filing a South Dakota Sales Tax Return.

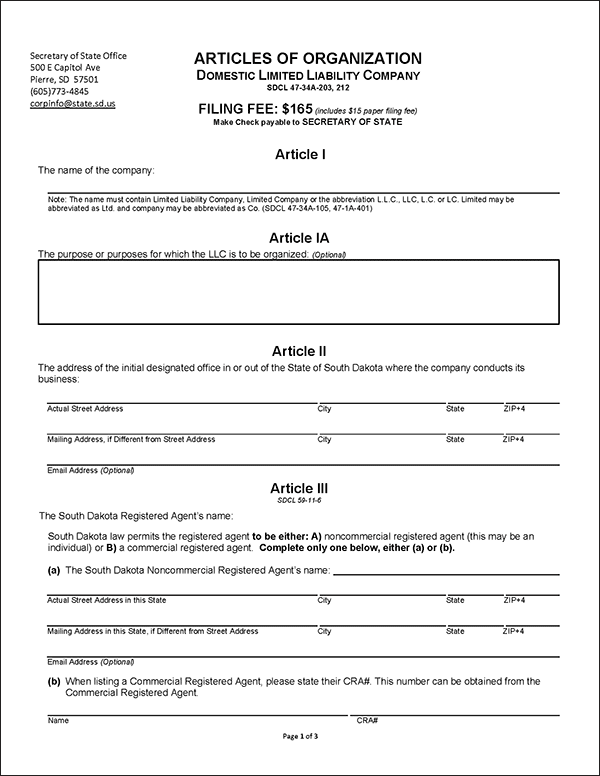

South Dakota Tax Application Office of the Secretary of State - Corporations Office of Economic Development. South Dakotas sales and use tax rate is 45 percent.

South Dakota Secretary Of State Sd Sos Business Search Secretary Of State Corporation Search

How To File And Pay Sales Tax In South Dakota Taxvalet

Online Retailers And State Sales Tax After South Dakota V Wayfair Blog Harbor Compliance

South Dakota Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

Sales Tax On Online Sales The Impact Of South Dakota Vs Wayfair Innovative Cpa Group

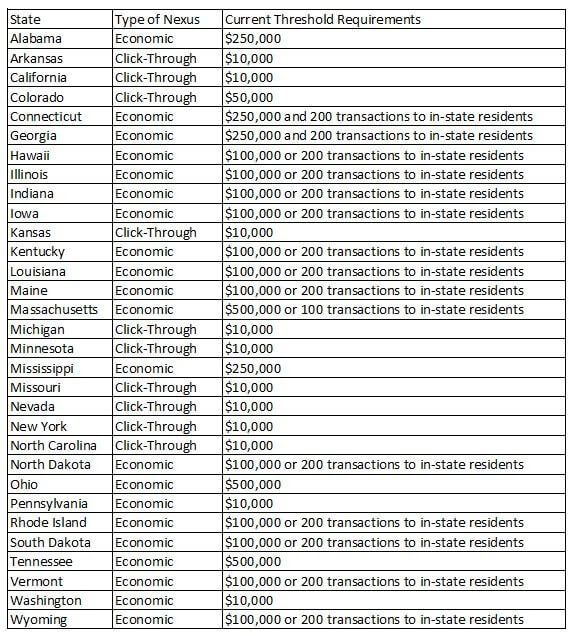

Online Sales Tax In 2022 The Impact Of The Supreme Court S Ruling

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

Sales Use Tax South Dakota Department Of Revenue

South Dakota V Wayfair Collecting Sales Tax From Online Sales

Supreme Court Divided On Sales Taxes For Online Purchases The New York Times

South Dakota Senate Rejects Sales Tax Cut Proposal Friday

State By State Guide To Economic Nexus Laws

Initial Sales Tax Figures Show Online Shopping A Major Force In South Dakota