maine property tax rates by town 2021

The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials. This map shows effective 2013 property tax rates for 488 Maine cities and towns.

Maine Property Tax Rates By Town The Master List

It is important to include an historic picture of the Towns tax rate so the reader can see the historic trends in.

. Yes No The Real Property Tax Service of Broome County seeks to improve the administration and understanding of the real property tax. Tax Rate Schedule 3. If the home value is 500000 or less the county transfer tax is 1 and if the home value is more than 500000 the transfer tax is 1425.

A mill is the tax per thousand dollars in assessed value. Maine Income Tax withholding Tables 2018. Click above to be redirected to the page where the files can be found by 4121 owner last name A-Z as well as Personal Property Business taxes.

Ad Property Taxes Info. Maine Property Tax Rates. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

The rates that appear on tax bills in Maine are generally denominated in millage rates. Town of Kennebunkport PO Box 566 6 Elm Street Kennebunkport ME 04046 PH. With thousands of properties and rural land for sale in the state these land listings account for a total of 67369 acres of land for sale in Maine.

State Treasurer Henry Beck has announced that the delinquency property tax rate can only top out at 6 percent for 2021 and he is also not applying an additional 3 percent penalty. Local government in Maine is primarily. 2021 Property Tax Levy.

Unsure Of The Value Of Your Property. 2021 Property Tax Rate. Foreclosure Homes in Maine.

The current millage rate or property tax rate per 1000 of assessed valuation is 1430. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory. 22 hours ago298 acres cutover timber land Washington County Georgia.

ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for Homestead and BETE Exemptions and TIFs Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466. The Town is proposing. How high is your towns property tax rate.

Enter the selected rate from page 10 line 19 of the Municipal Tax Rate Calculation Form. For Unmarried or Legally Separated Individuals who Qualify as Heads of Household. You need to know the Assessed Owner of Record as of April 1 2021 to search for a tax bill under that name.

For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. 11162021 1st half 05172021 2nd halfInterest Rate. If you need assistance please use ourweb formor call the Tax Collectors office.

27 rows Maine Relocation Services Local Tax Rates. Wishing Star Ranch is a great opportunity to own a piece of the growing East Texas. 499 rows Are you looking to move to a town or city in Maine but also want to get a sense of.

If your property is located in a different Aroostook County city or. Find All The Record Information You Need Here. Maine Property Tax School Belfast August 1-5 2022 IAAO Course.

Town of Oakfield is a locality in Aroostook County MaineWhile many other municipalities assess property taxes on a county basis Town of Oakfield has its own tax assessors office. State in e tax rates and brackets are available on this page maine in e tax rates for 2018 learn more about the latest updates for 2018 tax withholding with hr block find out how your paycheck may be impacted by the new 2018 withholding tables 2018 withholding updates Calculating Additional. 207 967-8470 Town Office Hours.

Compute the property tax levy by multiplying the total taxable valuation of real estate and personal property line 11 by the 2021 property tax rate line 12. Welcome to Maine Home Connection your comprehensive guide to Greater Portland real estate and the communities of southern Maine. Increase during FY 2021.

Property Tax Educational Programs. Maine Property Tax Institute online - May17-18 2022 Registration. There is a 60-day period before.

Maine Employee Health Trust rates increased only 189 from CY 2019 and staff. In-depth Johnston County NC Property Tax Information. 712021 to 6302022Tax Rate.

These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. The Median Maine property tax is 193600 with exact property tax rates varying by location and county. Tax Rate Schedule 2.

This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and Rhode Island. Property tax rates are also referred to as property mill rates. A wealth of information detailing valuations and exemptions by selected categories assessment ratios and tax rates on a town-by-town basis is compiled.

HAMPTON FALLS Selectmen have received the official 2021 property tax rate for the town from the state Department of Revenue Administration. Monday - Friday 800 am. Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax.

Less than 22450 58 of Maine taxable income 22450 but less than 53150 1302 plus 675 of excess over 22450 53150 or more 3374 plus 715 of excess over 53150.

Maine Property Tax Rates By Town The Master List

116 Woodbury Road In 2021 Maine House Colonial House Real Estate

What 1 Million Buys You In Maine Oregon And Connecticut The New York Times

Maine Property Tax Calculator Smartasset

Maine Property Tax Rates By Town The Master List

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Holmes Colonial Renovation Geek Stuff

Maine Property Tax Rates By Town The Master List

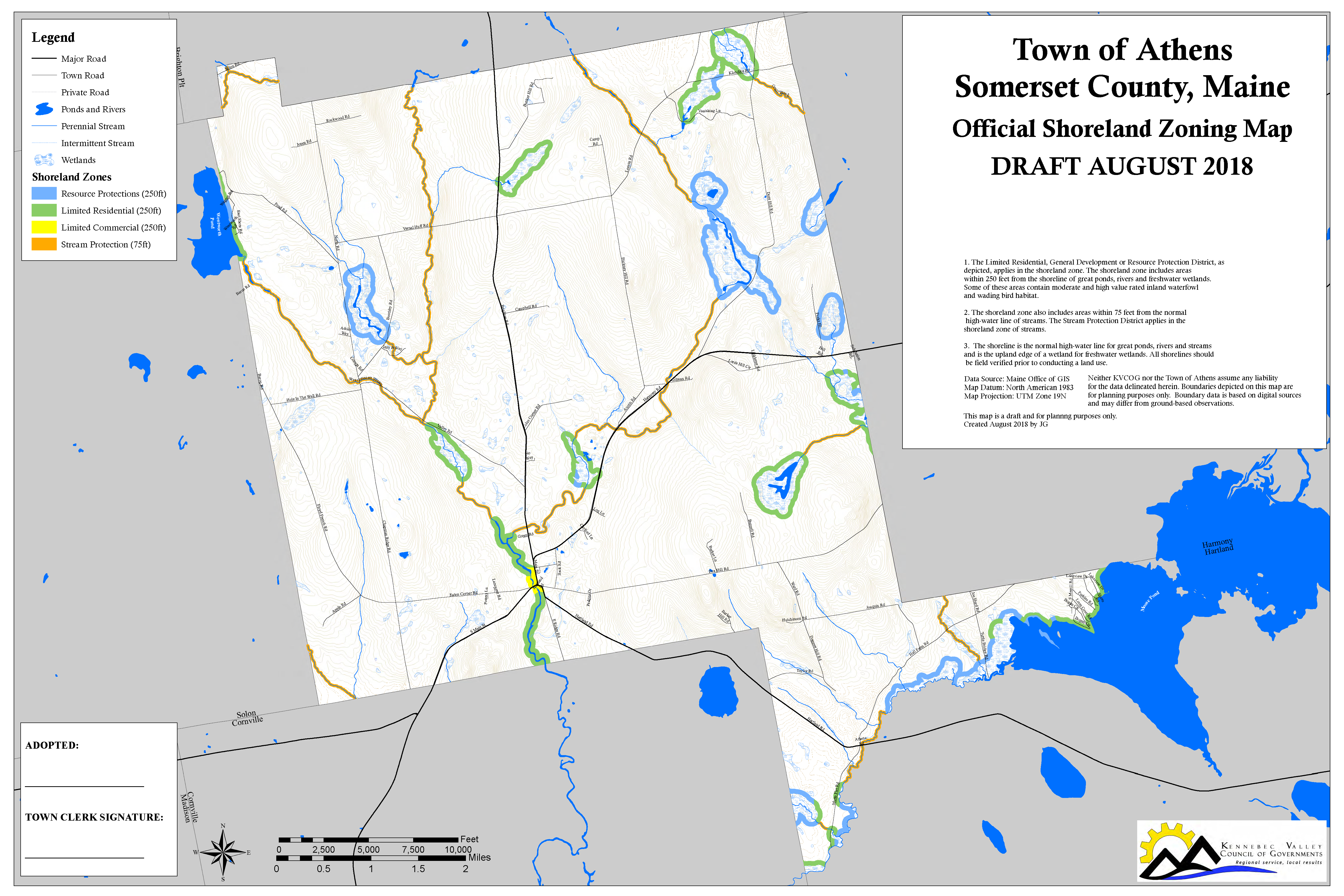

Resources Town Of Athens Maine Selectmen S Minutes Tax Maps

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Property Tax Rates By Town The Master List

Maine Considers Student Debt Relief For First Time Buyers In 2022 Student Debt Relief Student Debt Student

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Life Map Retirement

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Colonial Renovation Insulation Closed Cell Foam

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

Maine Property Tax Calculator Smartasset